Canadian Personal Finance That Actually Makes Sense

Learn TFSAs, RRSPs, and investing strategies built for Canada. Free weekly insights every Monday.

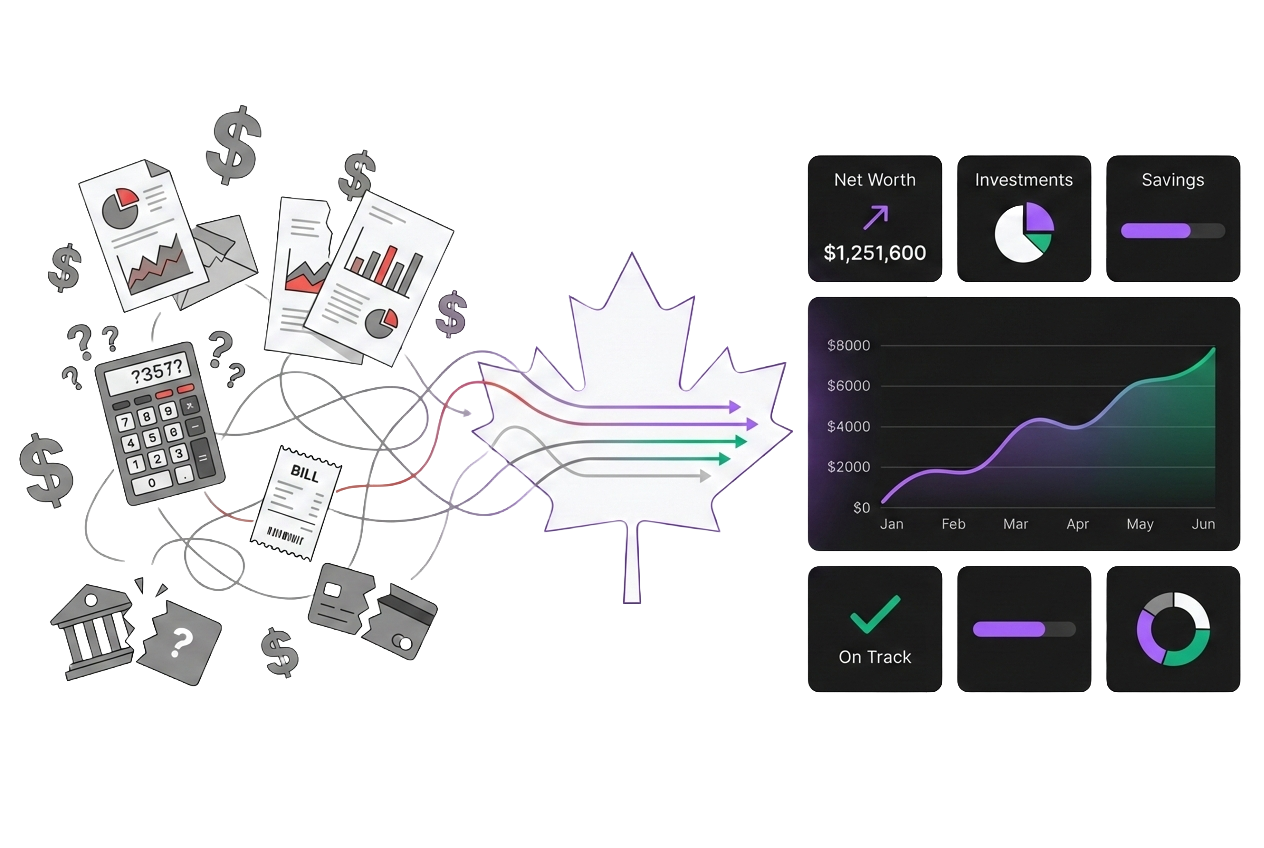

The Problem I'm Solving

When I moved to Canada, I expected financial opportunity. Instead, I found financial confusion.

Every financial tool assumed I understood the Canadian system. Every guide was built for Americans or buried in jargon.

Most Canadians—whether new or born here—face the same problem: clarity. Understanding where you stand, what decisions matter, and how today's choices affect your future.

That's what LoonieLens is built to solve.

— Jap, Founder

Canada Has a Money Clarity Problem

US-Focused Tools

Financial apps built for American systems. Advice about 401(k)s and IRAs doesn't translate to building wealth in Canada.

Missing the Big Picture

You track spending in one app, investments in another, and net worth in a spreadsheet. Nothing connects. You never see the complete story.

Information Overload

Conflicting advice from Reddit, YouTube, blogs, and financial gurus. Too much noise, not enough clarity on what actually matters.

No Clear Path Forward

Endless budgeting apps and conflicting advice, but no clear roadmap to understand: 'Am I actually building wealth? What should I do next?'

You're not bad with money. You just need clarity.

What We're Building at LoonieLens

A Complete Financial Dashboard

See your entire financial picture in one place: investments, savings, spending, net worth. Built for how Canadians actually save and invest.

AI-Powered 'What-If' Scenarios

What if I max my TFSA vs RRSP this year? What if I save for a home in 3 years? Get answers before you commit.

Understand Your Progress

Track how you're actually doing over time. See trends, understand what's working, and know if you're on track to hit your goals.

Weekly Financial Clarity

Learn how Canadian personal finance actually works. One actionable insight every Monday. No jargon, no American advice, just clarity.

Your Financial Clarity Journey

Financial Education

Every Monday: Learn how to make better money decisions. Understand Canadian taxes, investing, and wealth-building strategies.

Financial Tools

Access tools that show your complete financial picture: net worth tracking, scenario planning, investment analysis, and progress monitoring.

Financial Freedom by 50

Use education + tools to achieve clarity, confidence, and financial freedom.

Two Paths Forward

Keep Googling

- Piece together advice from dozens of sources

- Wonder if you're making the right decisions

- Feel anxious instead of confident about money

- Never know if you're actually on track

Get Clarity

- Understand your complete financial picture

- Make confident decisions with clear information

- See exactly where you stand and where you're going

- Build wealth with a system that makes sense

Which path sounds better?

Our Mission: 1 Million Canadians, Financial Freedom by 50

Most Canadians don't have a money problem—they have a clarity problem. They don't know where they stand, what decisions matter most, or how today's choices affect tomorrow. LoonieLens is building the education and tools to fix that.